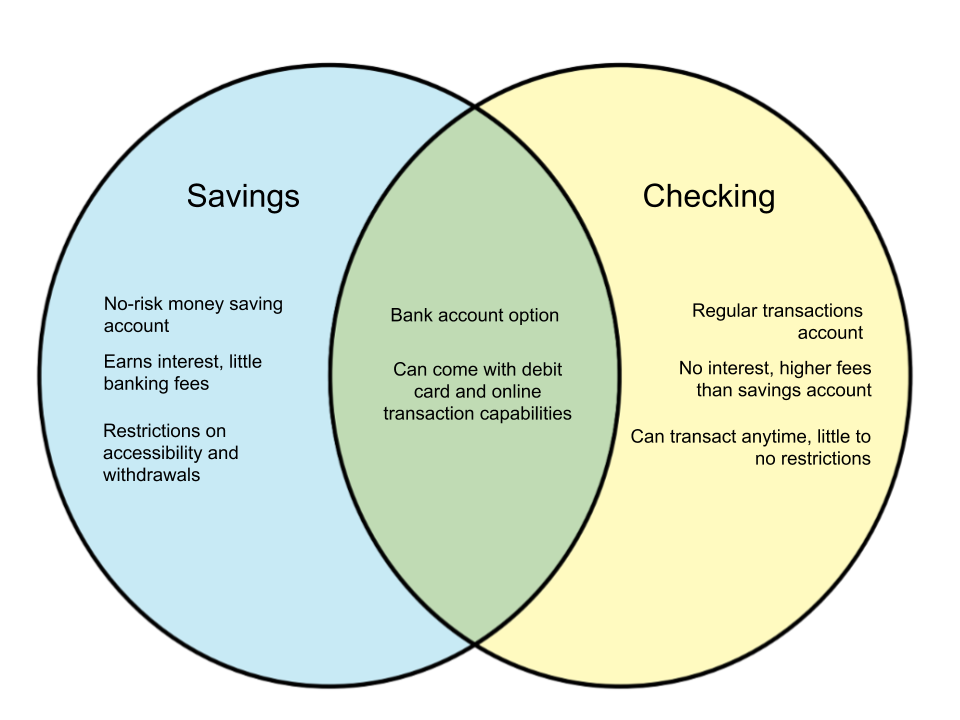

Contrasts Between Checking Accounts and Savings Accounts

Unearth the Secrets of Checking vs. Savings Accounts! Discover Which Puts More Cash in Your Pocket! Dive In Now!

Describe the Differences Between a Checking Account and a Savings Account

When it comes to managing your finances, two of the most fundamental tools at your disposal are checking accounts and savings accounts. These accounts serve distinct purposes and offer different features, making them essential for various aspects of your financial life. Understanding the differences between these two types of accounts is crucial for effective money management. In this comprehensive guide, we will delve into the distinctions between checking accounts and savings accounts, helping you make informed decisions about how to utilize them to achieve your financial goals.

Checking Account: An Overview

A checking account is a widely used financial tool that provides account holders with easy access to their funds for day-to-day transactions. Let's take a closer look at the key features and characteristics of a checking account:

Liquidity: Checking accounts are highly liquid, meaning you can access your money easily and quickly. You can withdraw cash, write checks, use a debit card, or make electronic transfers to pay bills or make purchases.

Unlimited Transactions: One of the primary benefits of a checking account is that it typically offers unlimited transactions. This means you can deposit and withdraw money as often as needed without incurring additional fees.

No Interest or Low Interest: Checking accounts usually offer minimal or no interest on the balance. While they may provide some interest, it is generally lower than what you can earn with a savings account.

Overdraft Protection: Many checking accounts come with overdraft protection, which can help prevent declined transactions or costly overdraft fees by allowing you to temporarily overdraft your account, typically for a fee.

Minimum Balance Requirement: Some checking accounts require a minimum balance to avoid monthly maintenance fees. However, these requirements are often lower than those for savings accounts.

Access to ATMs: Checking accounts often provide access to a wide network of ATMs, allowing you to withdraw cash without incurring additional fees when using in-network ATMs.

Savings Account: An Overview

A savings account is designed for a different financial purpose than a checking account. It's intended to help you save and grow your money over time while keeping it easily accessible when needed. Here are the key features and characteristics of a savings account:

Interest Earnings: Savings accounts are known for offering interest on the balance you maintain. While interest rates can vary, savings accounts generally provide a higher rate of return compared to checking accounts.

Limited Transactions: Unlike checking accounts, savings accounts typically have limitations on the number of withdrawals or transfers you can make per month. Federal regulations often limit these transactions to six per statement cycle.

Safety and Security: Savings accounts are considered a safe place to keep your money. They are often insured by the Federal Deposit Insurance Corporation (FDIC) or the National Credit Union Administration (NCUA) up to a certain limit, providing peace of mind against loss.

Emergency Fund: Savings accounts are commonly used to build emergency funds or save for specific financial goals, such as a vacation, a down payment on a home, or retirement.

Higher Minimum Balance: Some savings accounts require a higher minimum balance compared to checking accounts to earn interest or avoid fees. These requirements vary from bank to bank.

Less Access to ATMs: While savings accounts may come with ATM access, it's often limited, and you may face fees for out-of-network ATM withdrawals.

Differences Between Checking and Savings Accounts

Now that we've explored the individual characteristics of checking and savings accounts, let's dive deeper into the key differences between the two:

Purpose:

Checking Account: Designed for everyday transactions, bill payments, and easy access to your money.

Savings Account:?Intended for saving money over the long term, earning interest on your balance, and achieving specific financial goals.

Checking Account: Allows unlimited transactions, making it suitable for daily use.

Savings Account:?Typically limits the number of withdrawals or transfers you can make per month to encourage savings.

Checking Account: Offers minimal or no interest on the balance.

Savings Account:?Offers higher interest rates, helping your money grow over time.

Checking Account: Provides easy and frequent access to your money through various means, including checks, debit cards, and electronic transfers.

Savings Account:?Designed for less frequent access to encourage saving and discourage spending.

Checking Account: May have lower minimum balance requirements to avoid fees.

Savings Account:?Often requires a higher minimum balance to earn interest or avoid fees.

Checking Account: May have monthly maintenance fees, but they are often easier to avoid with lower minimum balance requirements or direct deposit arrangements.

Savings Account:?Typically has fewer fees, especially if you maintain the required minimum balance.

Checking Account: Generally considered safe for everyday transactions but does not offer substantial interest earnings.

Savings Account:?Offers interest earnings and is often insured up to a certain limit, providing an extra layer of safety for your savings.

Checking Account: Used for managing day-to-day expenses and transactions.

Savings Account: Ideal for saving money for emergencies, future goals, or planned expenditures.

Choosing the Right Account for Your Needs

Selecting the right type of account depends on your financial goals and how you plan to use the account. Here are some considerations to help you decide:

Checking Account is Suitable If:

You need frequent access to your money for everyday expenses.

You want to use checks, a debit card, or electronic transfers for payments.

You prefer an account with no or low minimum balance requirements.

Savings Account is Suitable If:

You want to earn interest on your savings.

You are saving for specific financial goals like an emergency fund, a vacation, or a down payment on a house.

You can limit your withdrawals to stay within the monthly transaction limit.

Consider a Combination:

Many individuals use both types of accounts to balance their financial needs. They maintain a checking account for day-to-day transactions and a savings account to grow their money over time.

Compare Account Options:

Different banks and credit unions offer various checking and savings account options. Compare interest rates, fees, and features to find the accounts that best align with your financial objectives.

Checking accounts and savings accounts serve distinct purposes in your financial life. Checking accounts are designed for everyday transactions, offering easy access to your money, while savings accounts are geared toward growing your money over time through interest earnings. Understanding the differences between these accounts is essential for effective money management. By selecting the right account or combination of accounts based on your financial goals and needs, you can take control of your finances and work towards a secure financial future.

What's Your Reaction?