The Benefits of Investing in the Stock Market for Beginners

Unlock Financial Success: Discover the Advantages of Stock Market Investing for Newbies! Start Your Wealth Journey Today. Learn More Now!

How to Start Investing in the Stock Market for Beginners

Investing in the stock market can be a rewarding and potentially lucrative way to grow your wealth over time. However, for beginners, the world of stocks can seem complex and daunting. The good news is that with the right knowledge and a solid plan, anyone can start investing in the stock market. In this comprehensive guide, we will walk you through the steps to help you get started on your journey to becoming a successful stock market investor.

Understand the Basics

Before you dive into the world of stock market investing, it's essential to understand the basics. Here are some key concepts to grasp:

Stocks: Stocks represent ownership in a company. When you buy a stock, you become a shareholder and have a claim on the company's assets and earnings.

Risk and Return: Investing in stocks comes with risks, but it also offers the potential for high returns. The stock market can be volatile, so it's important to be prepared for fluctuations in the value of your investments.

Diversification: Spreading your investments across different stocks or asset classes can help reduce risk. Diversification is a fundamental strategy for long-term success in the stock market.

Investment Horizon: Determine your investment horizon, which is the length of time you plan to hold your investments. Different strategies work for short-term and long-term investors.

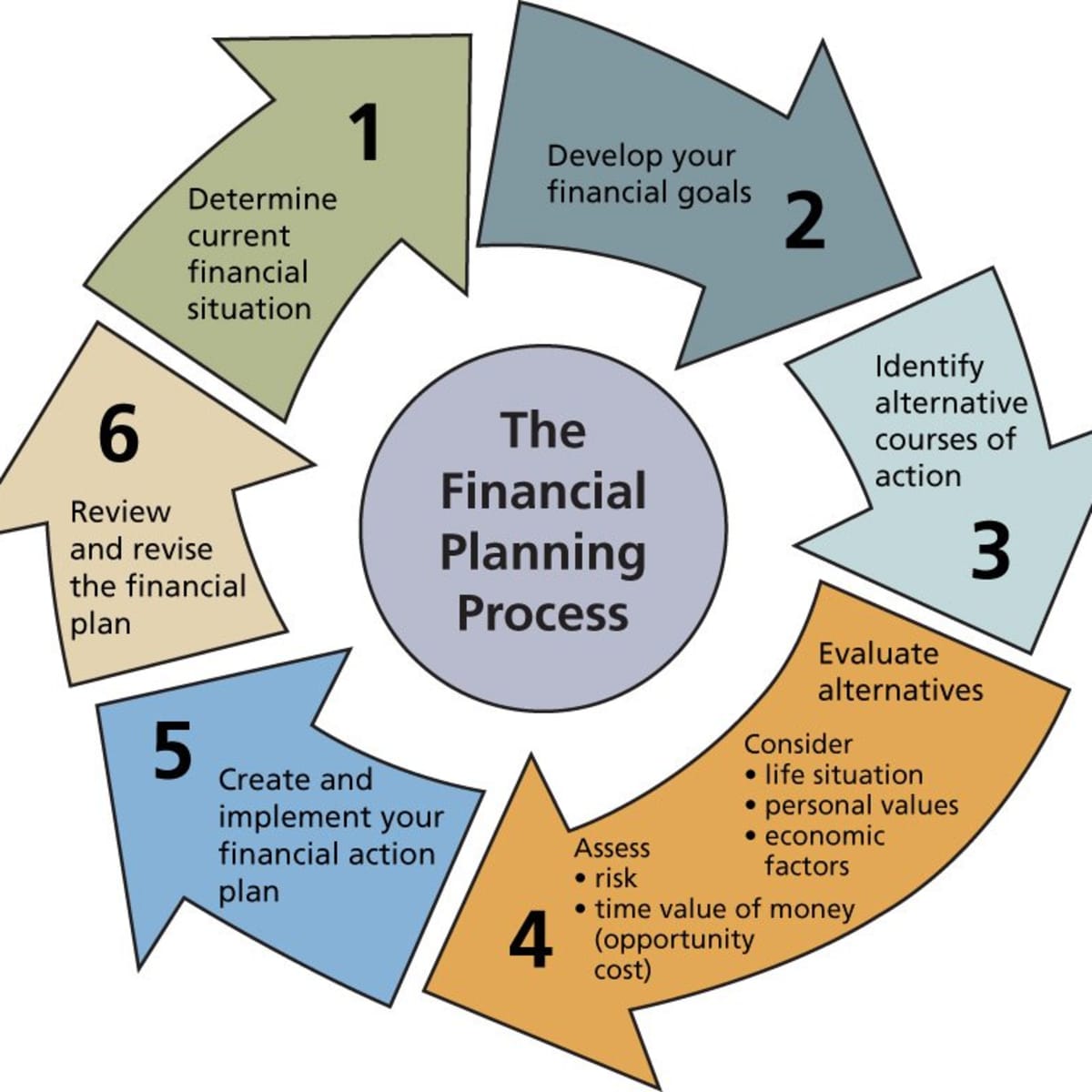

Set Clear Goals

Before you start investing, define your financial goals. Are you investing for retirement, a major purchase, or simply to grow your wealth? Your goals will shape your investment strategy and help you make informed decisions.

Create a Budget

Evaluate your current financial situation and create a budget. Determine how much money you can comfortably allocate to your investment portfolio without affecting your day-to-day expenses and emergency savings. It's crucial to invest only what you can afford to lose.

Build an Emergency Fund

Before you start investing, ensure you have an emergency fund in place. This fund should cover at least three to six months' worth of living expenses. Having an emergency fund provides a financial safety net in case unexpected expenses arise.

Pay Off High-Interest Debt

If you have high-interest debt, such as credit card balances, consider paying it off before you start investing. High-interest debt can erode your wealth faster than your investments can grow.

Choose the Right Investment Account

To invest in stocks, you'll need a brokerage account. Research and compare different brokerage firms to find one that suits your needs. Look for low fees, a user-friendly platform, and a variety of investment options.

Educate Yourself

Investing in stocks requires knowledge and research. Start by reading books, articles, and websites dedicated to stock market investing. Understanding financial statements, market trends, and investment strategies will empower you to make informed decisions.

Learn about Investment Options

There are various investment options within the stock market, including individual stocks, exchange-traded funds (ETFs), and mutual funds. Each option has its advantages and disadvantages. Take the time to learn about them and decide which suits your investment goals.

Create a Diversified Portfolio

Diversification is a crucial strategy to reduce risk in your investment portfolio. Instead of putting all your money into a single stock, consider spreading it across different stocks or asset classes. This can help protect your investments from significant losses if one company or sector underperforms.

Start with Index Funds or ETFs

For beginners, index funds and ETFs are excellent choices. These investment vehicles track the performance of a specific market index, such as the S&P 500. They offer diversification and are generally less volatile than individual stocks.

Dollar-Cost Averaging

Dollar-cost averaging is a strategy where you invest a fixed amount of money at regular intervals, regardless of market conditions. This approach can help you avoid trying to time the market and reduce the impact of market volatility on your investments.

Create an Investment Plan

Develop an investment plan that outlines your financial goals, risk tolerance, and asset allocation strategy. Having a plan in place will keep you focused and disciplined during market fluctuations.

Monitor Your Investments

Regularly review your investment portfolio to ensure it aligns with your goals and risk tolerance. Adjust your holdings if necessary, but avoid making impulsive decisions based on short-term market fluctuations.

Stay Informed

Stay updated on market news and economic developments that could impact your investments. Knowledge is your best defense against unexpected market events.

Practice Patience

Stock market investing is a long-term endeavor. Avoid the temptation to make frequent trades or react emotionally to market fluctuations. Patient investors tend to achieve better results over time.

Consider Tax Implications

Be aware of the tax implications of your investments. Different types of accounts, such as individual retirement accounts (IRAs) and 401(k)s, offer tax advantages. Consult with a tax professional to optimize your tax strategy.

Seek Professional Advice

If you're uncertain about your investment choices or need personalized guidance, consider consulting a financial advisor. A professional can help you create a tailored investment plan and provide valuable insights.

Stay Committed

Successful investing in the stock market requires commitment and discipline. Stick to your investment plan, avoid emotional decisions, and continue to educate yourself about the market.

Learn from Mistakes

It's common for investors to make mistakes along the way. Instead of dwelling on them, view them as learning opportunities. Analyze what went wrong and adjust your strategy accordingly.

Prepare for Market Volatility

Stock markets can be volatile, with ups and downs. It's essential to have a long-term perspective and not panic during market downturns. Historically, markets have recovered from downturns and continued to grow.

Review and Adjust

Periodically review your investment portfolio to ensure it aligns with your goals and risk tolerance. As your financial situation changes, you may need to adjust your investments accordingly.

Reinvest Dividends

If you invest in dividend-paying stocks or funds, consider reinvesting the dividends to take advantage of compounding. Reinvesting dividends can significantly boost your long-term returns.

Stay the Course in Bear Markets

Bear markets, characterized by declining stock prices, can be challenging for investors. However, selling during a bear market can lock in losses. Instead, consider staying invested and even buying more if you have the financial means to do so.

Automate Your Investments

Consider setting up automatic contributions to your investment account. This ensures that you consistently invest, regardless of market conditions or fluctuations in your income.

Keep Emotions in Check

Emotional reactions can lead to impulsive investment decisions. Stay rational and stick to your plan, even when the market experiences turbulence.

Utilize Online Resources

Take advantage of online resources, such as investment calculators, stock screeners, and financial news websites, to enhance your investment knowledge and decision-making.

Understand Risk Tolerance

Your risk tolerance is a critical factor in determining your investment strategy. Be honest with yourself about how much risk you are comfortable with, as it will influence your asset allocation.

Avoid Chasing Hot Stocks

Don't invest in a stock simply because it's currently popular or has recently experienced significant gains. Often, these stocks come with higher risks and may not be suitable for long-term investors.

Embarking on your journey as a beginner in the stock market can be both exciting and challenging. However, with the right knowledge, a clear plan, and a commitment to long-term goals, you can navigate the complexities of the stock market successfully. Remember to educate yourself, set clear objectives, diversify your investments, and stay patient and disciplined throughout your investment journey. With time and persistence, you can work toward achieving your financial aspirations and securing a more prosperous future.

What's Your Reaction?