The Impact of a Realistic Financial Plan for Your Future

Uncover the Life-Changing Power of a Realistic Financial Plan! Secure Your Future Today. Say Goodbye to Financial Stress.

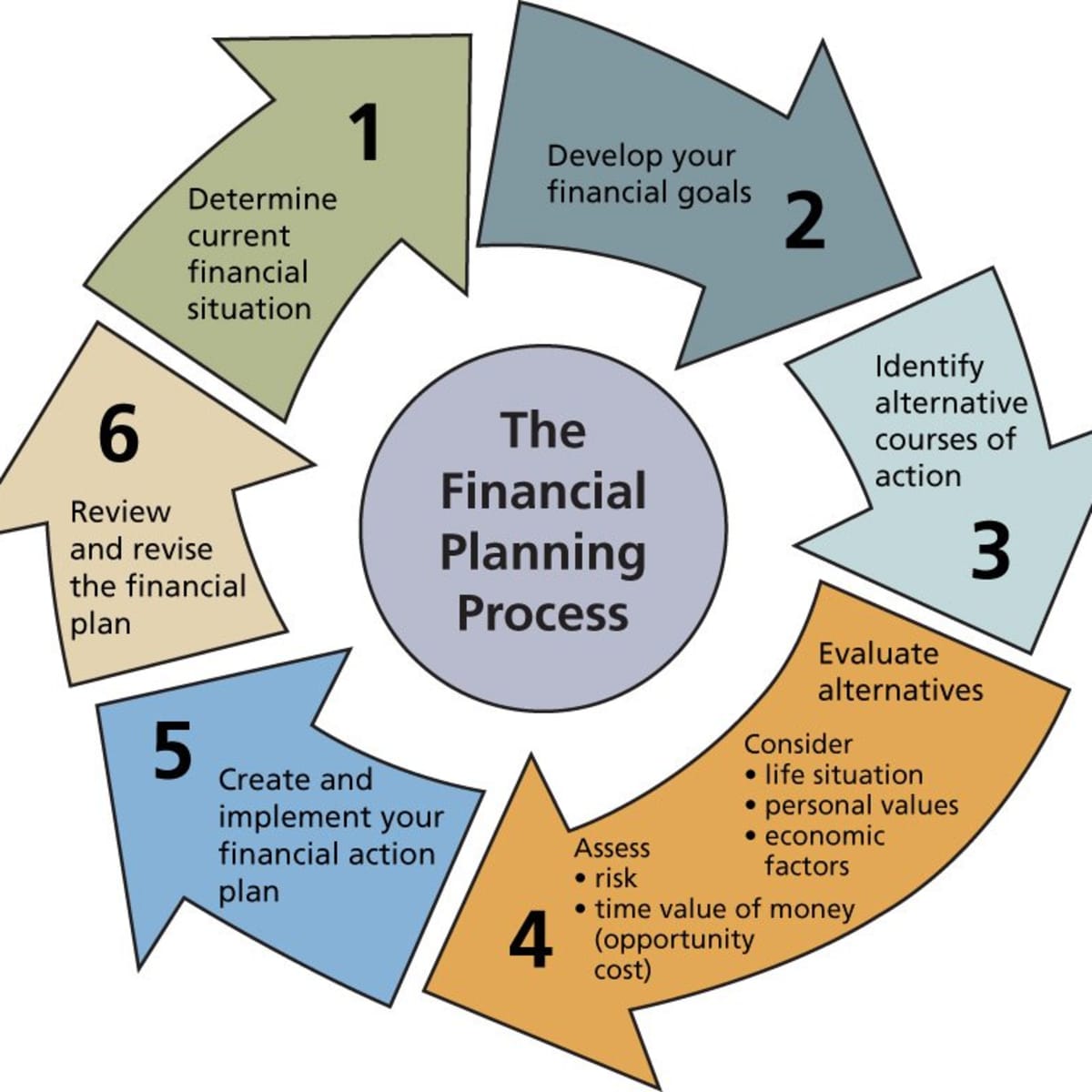

How to Create a Realistic Financial Plan for Your Future

Creating a realistic financial plan is essential for achieving your long-term financial goals and ensuring a secure future. Whether you dream of retiring comfortably, buying a home, sending your children to college, or simply achieving financial independence, a well-thought-out financial plan can make all the difference. In this guide, we will take you through the steps to create a realistic financial plan that is tailored to your unique circumstances and aspirations. By following these guidelines, you can pave the way for a financially secure and prosperous future.

Assess Your Current Financial Situation

Before you can create a realistic financial plan, you must first understand where you currently stand financially. This involves taking a close look at your income, expenses, assets, and liabilities. Here's how to get started:

Calculate Your Net Worth: Begin by listing all your assets (e.g., savings, investments, property) and subtracting your liabilities (e.g., loans, credit card debt). The resulting number is your net worth, which is a snapshot of your current financial health.

Review Your Income and Expenses: Examine your monthly income sources and track your expenses for a few months. This will give you a clear picture of your spending habits and where you may be able to cut back or save more.

Set Clear Financial Goals

Once you have a grasp of your current financial situation, it's time to define your long-term financial goals. Your goals will serve as the foundation of your financial plan. Make sure your goals are specific, measurable, achievable, relevant, and time-bound (SMART). Common financial goals include:

Retirement Planning: Determine when you want to retire and how much you need to save to maintain your desired lifestyle during retirement.

Homeownership: Decide if you want to buy a home and estimate the down payment and monthly mortgage payments.

Education: If you have children, plan for their education expenses, including college tuition and other related costs.

Emergency Fund: Set aside funds for unexpected expenses or emergencies.

Debt Reduction: Create a plan to pay off high-interest debt, such as credit cards or loans.

Investment Goals: Consider your investment objectives, whether it's wealth accumulation, income generation, or both.

Create a Budget

A budget is a crucial tool for managing your finances and achieving your goals. It helps you allocate your income effectively, control expenses, and ensure you're saving enough for the future. Here's how to create a budget:

List Your Income Sources: Make a comprehensive list of all your sources of income, including your salary, rental income, dividends, and any other sources.

Track Your Expenses: Categorize your expenses into fixed (e.g., rent or mortgage, utilities) and variable (e.g., dining out, entertainment). Use budgeting software or apps to track your expenses easily.

Create a Spending Plan: Allocate specific amounts to each expense category based on your financial goals and priorities. Ensure you set aside a portion of your income for savings and investments.

Stick to Your Budget: The key to budgeting success is consistency. Monitor your spending regularly and make adjustments as needed to stay on track.

Build an Emergency Fund

An emergency fund is a financial cushion that can protect you from unexpected expenses, such as medical bills, car repairs, or job loss. Financial experts typically recommend saving three to six months' worth of living expenses in your emergency fund. Start by saving a small amount each month and gradually increase it until you reach your target.

Manage and Reduce Debt

High-interest debt can hinder your ability to save and invest for the future. Prioritize paying off high-interest debts, such as credit card balances, as part of your financial plan. Consider debt consolidation or refinancing options to lower interest rates and make repayment more manageable.

Save and Invest Wisely

Saving and investing are key components of any realistic financial plan. Here are some strategies to consider:

Save Automatically: Set up automatic transfers from your checking account to your savings or investment accounts. This ensures you consistently save a portion of your income without much effort.

Diversify Your Investments: Spread your investments across different asset classes (stocks, bonds, real estate) to reduce risk and maximize returns over the long term.

Take Advantage of Retirement Accounts: Contribute to retirement accounts like 401(k)s or IRAs, especially if your employer offers matching contributions.

Invest for the Long Term: Avoid making impulsive investment decisions based on short-term market fluctuations. Focus on your long-term goals and stay disciplined.

Seek Professional Advice: Consider consulting with a financial advisor or planner to develop an investment strategy that aligns with your goals and risk tolerance.

Review and Adjust Your Plan Regularly

Financial planning is not a one-time task. Your circumstances, goals, and economic conditions can change over time. It's essential to review and adjust your financial plan regularly. Here's how:

Annual Checkup: Set aside time each year to review your financial goals, budget, and investments. Make any necessary adjustments to stay on track.

Life Events: Major life events like marriage, having children, or changing jobs may require adjustments to your financial plan.

Economic Changes: Be mindful of economic factors like inflation, interest rates, and market conditions that can impact your financial plan.

Seek Professional Guidance: If you're unsure about how to make adjustments or need guidance, consider consulting with a financial advisor.

Protect Your Financial Future

Insurance plays a vital role in protecting your financial well-being. Ensure you have the necessary insurance coverage, including health insurance, life insurance, disability insurance, and homeowners or renters insurance. Review your policies regularly to ensure they align with your current needs and circumstances.

Creating a realistic financial plan for your future is a proactive step toward achieving financial security and reaching your long-term goals. By assessing your current situation, setting clear goals, budgeting, saving, investing wisely, and regularly reviewing and adjusting your plan, you can navigate the complex world of finance with confidence. Remember that financial planning is a journey, and with dedication and discipline, you can build a brighter and more secure financial future for yourself and your loved ones.

What's Your Reaction?