General Trade vs Modern Trade | Evolving Trading Trends

Explore modern trading, general trade vs modern trade, and algo trading software price. Learn how trade is shifting in today’s competitive market.

General Trade vs Modern Trade: Understanding the Shift in Commerce

Introduction

Have you ever walked into a cozy corner shop where the shopkeeper knows your name? Thats general tradesimple, personal, and traditional. Now, think of the bright lights and endless shelves of a modern supermarketwelcome to modern trade. The world of commerce has evolved, and so have the ways we buy and sell. But whats the real difference between these two? And more importantly, how does it affect you and the economy at large?

In this article, well dive deep into general trade vs modern trade, unpack what each means, how they work, and how modern trading is changing the gameincluding a sneak peek at algo trading software price and how automation is shaping the future.

Explore modern trading, general trade vs modern trade, and algo trading software price. Learn how trade is shifting in todays competitive market.

What is General Trade?

General Trade refers to the traditional method of retailing where goods are sold through small, independent shops. Think of local kirana stores, small grocery shops, or mom-and-pop stores. These retailers usually have strong relationships with their customers and operate with limited inventory.

Key features of general trade:

-

Small-scale, neighborhood-based

-

Cash transactions

-

Personal relationships with customers

-

Less reliance on technology

What is Modern Trade?

Modern Trade includes large retail chains, supermarkets, hypermarkets, and organized retail formats. It emphasizes efficiency, technology, and volume-based sales.

Examples of modern trade stores:

-

Reliance Fresh

-

D-Mart

-

Big Bazaar (Future Retail)

-

Online platforms like Amazon and Flipkart

Modern trading focuses on a seamless buying experience, better stock management, and tech-based customer engagement.

Key Differences: General Trade vs Modern Trade

Heres a simple analogyif general trade is a handwritten letter, modern trade is an email. Both deliver the message, but one is quicker, more scalable, and data-friendly.

|

Aspect |

General Trade |

Modern Trade |

|

Scale |

Small and localized |

Large and organized |

|

Technology |

Minimal |

High usage (POS, data, apps) |

|

Inventory |

Limited |

Extensive |

|

Customer Base |

Known personally |

Broad and impersonal |

|

Payment Method |

Mostly cash |

Digital options |

Why Modern Trade is Gaining Popularity

Why are more people moving to modern trading platforms?

Simpleit's about convenience.

With wider product ranges, clean environments, loyalty programs, and faster checkouts, modern trade provides a complete shopping experience.

Moreover, peoples lifestyles have changed. We want speed, comfort, and consistencyand modern trade delivers just that.

Benefits of General Trade

Despite the rise of modern retail, general trade isnt going away anytime soon. It has several benefits:

-

Personal service: The shopkeeper often knows your preferences.

-

Credit facility: Buy now, pay later (often not available in supermarkets).

-

Accessibility: Found in every corner of India, even in remote areas.

-

Quick purchases: No need to roam long aisles.

Challenges Faced by Traditional Trade

While general trade has its charm, it faces multiple issues:

-

Limited capital to expand or upgrade

-

Poor inventory tracking

-

Inconsistent pricing

-

Lack of brand visibility

-

No adoption of technology tools

These limitations make it hard for general trade to compete with the slick systems of modern trade.

Technology in Modern Trade

Modern trade thrives on technology. From barcode scanners to automated billing, every part of the system is designed to improve efficiency.

Key technologies used:

-

Point-of-sale (POS) systems

-

Inventory management software

-

Customer Relationship Management (CRM)

-

Loyalty card programs

-

Mobile apps and QR payment systems

This data-driven approach helps in understanding customer trends and managing stock smartly.

Understanding Modern Trading Models

Modern trading isnt just about supermarkets. It includes:

-

Omni-channel retailing: Combining online and offline sales

-

Warehouse clubs: Bulk buying at lower prices

-

Convenience chains: Small stores with high-tech systems

-

E-commerce platforms: Online marketplaces and apps

These models give customers multiple touchpoints to shopenhancing the experience.

How Customer Behavior is Driving Change

Todays customer is tech-savvy and time-conscious. We want:

-

Instant service

-

Product variety

-

Seamless returns

-

Discounts and cashback

General trade is struggling to keep up, while modern trade is adapting fast. This shift in demand is pushing businesses to go digital or risk falling behind.

Supply Chain: Traditional vs Modern

The supply chain in general trade is fragmented. Goods move from distributor ? wholesaler ? retailer. There's little tracking or real-time data.

Modern trade uses:

-

Direct-to-store delivery

-

Centralized warehousing

-

Inventory software

-

Live tracking

This makes stock replenishment faster and less prone to errors.

Role of Data and Analytics

In modern trade, data is king. Retailers collect and analyze:

-

Purchase patterns

-

Foot traffic

-

Product performance

-

Customer preferences

These insights help in personalized promotions and stocking the right productssomething general trade cant yet compete with.

Digital Payments and E-Commerce

Digital India is boomingand so are cashless payments. Modern trading integrates:

-

UPI

-

Credit/Debit cards

-

Wallets (Paytm, PhonePe)

-

Net banking

Meanwhile, general trade still largely depends on cash, limiting flexibility for tech-savvy consumers.

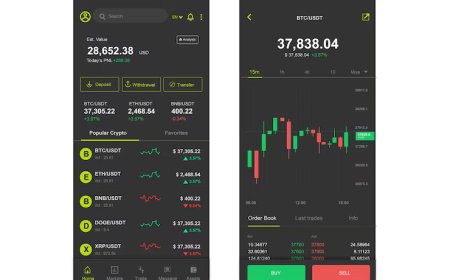

Algo Trading: Future of Modern Trade?

Algorithmic tradingpopular in stock marketsis now influencing retail operations too.

In financial markets, modern trading uses algorithms to make data-backed, real-time trades. Retail is adopting a similar logic for:

-

Dynamic pricing

-

Demand forecasting

-

Stock automation

In both sectors, data + automation = smarter decisions.

Algo Trading Software Price Explained

You might wonder, whats the algo trading software price?

The cost varies based on:

-

Features (backtesting, speed, AI models)

-

Platform support (NSE, BSE, MCX)

-

Subscription model (monthly/yearly)

-

Broker integration

Price range: ?5,000/month to ?50,000+ depending on sophistication.

Some platforms even offer free trials, but for robust results, premium plans with live market feeds and predictive analytics are the best bet.

What Lies Ahead for Retail in India?

India is at a turning point. With rising urbanization, internet access, and disposable incomes, modern trade is set to dominate. However, general trade still plays a crucial role in semi-urban and rural areas.

The future? A hybrid modelwhere even small retailers use apps, online ordering, and digital payments to keep up with the trend.

Conclusion

In the clash of general trade vs modern trade, its clear that both have their own strengths. While one offers personal connection, the other promises speed, variety, and convenience. With modern trading on the rise and technologies like algo trading making waves, the retail landscape is undergoing a digital revolution. The key for businesses? Adapt, upgrade, and evolve.

FAQs

1. What is the main difference between general trade and modern trade?

General trade is traditional retail with local shops and minimal tech, while modern trade includes organized, tech-driven retail formats like supermarkets and e-commerce.

2. Why is modern trade growing faster than general trade?

Because it offers convenience, wide product choices, digital payments, and a better overall customer experience.

3. How does algo trading relate to modern trade?

Algo trading uses automation and data analysis, which retail businesses now use for stock management, pricing, and sales forecasting.

4. Is general trade disappearing in India?

No, but it's evolving. Many local shops are adopting digital tools to stay competitive.

5. What is the typical algo trading software price in India?

Prices range from ?5,000 to ?50,000+ per month depending on features, speed, and market access.