How Financial Advisory Companies Help You Achieve a Financially Stronger Tomorrow

Whether you are planning for retirement, wealth management, or choosing the most appropriate life insurance policy UAE citizens use, expert financial advice will ensure that you avoid wasting precious money on avoidable errors and stay centered on your long-term goals.

Achieving a secure financial tomorrow is no longer a luxury but an imperative, especially in the uncertain financial landscape we find ourselves in nowadays. Increasing numbers of individuals and corporations are approaching financial advisory companies in Dubai to guide their financial choices with ease and expertise. Whether you are planning for retirement, wealth management, or choosing the most appropriate life insurance policy UAE citizens use, expert financial advice will ensure that you avoid wasting precious money on avoidable errors and stay centered on your long-term goals.

Understanding the Significance of Financial Planning

Successful financial planning starts with a clear vision of where you are today and a realistic notion of where you want to be tomorrow. Everyone understands that they must save, invest, and plan for retirement, but doesn't have the know-how or time to get an effective plan underway. That is where a professional advisor enters the picture.

Financial planners assist you in dividing your objectivessuch as homeownership, education for kids, retirement before normal age, or risk coverageinto manageable steps. They consider your earnings, expenditures, assets, and obligations to formulate a plan suitable for your lifestyle and future goals.

Tailor-Made Plans Suited to Your Requirements

One of the main advantages of availing financial advisory firms is that you receive personalized, unbiased advice. They do not sell you any product. They study your individual profile and recommend solutions that are appropriate for your current age and future needs.

For example, in case you want to have a family, a life insurance policy UAE insurance companies offer can ease your mind by taking care of the people you love in case of an emergency. Or if you're nearing retirement, an advisor will help you invest in a manner that reduces risk and ensures a steady income stream when you retire.

Investment Guidance That Makes Sense

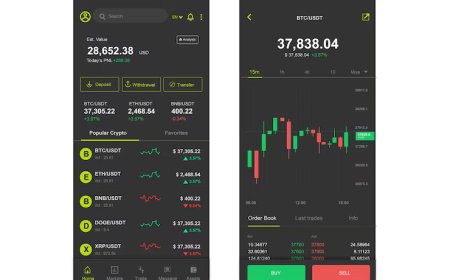

Most individuals end up losing opportunities or losing money simply because they invest out of speculation or trends rather than a sound plan. An efficient financial advisor helps you grasp your risk tolerance and guides your investment alternatives to suit it.

Rather than seeking high-risk returns, financial advisors help you diversify your portfolio in a way that optimizes growth against stability. Whether you are investing in shares, real estate, or mutual funds, your advisor ensures that every move is a step closer to your long-term financial vision.

Tax-Efficient Financial Strategies

More people than you might expect pay too much tax simply because they have not been informed of the tax-saving mechanisms they can claim. Financial advisers have knowledge of local tax regulations and can assist you in exploiting legitimate means of minimizing tax payments.

For UAE citizens, this can involve planning offshore income, investments, and structuring insurance policies. Several financial advisory companies in Dubai provide tax optimization as one component of the overall planning solutions, allowing clients to legally and smartly save more of their wealth.

Preparing for Life's Uncertainties

Life is full of unexpected thingslayoffs, sickness, or stock market crashes. You can't prevent them from happening, but you can prepare for them. Risk management is a big part of the work of a financial advisor. This includes having sufficient funds in reserve in case of emergencies, adequate insurance protection, and backup plans for sudden financial setbacks.

Particularly in the UAE, taking out a life insurance cover is one way to secure your family's future. Your financial planner chooses a policy for you that not only fits your pockets but also has adequate cover to fit your family's requirements in case of your untimely demise.

Long-Term Relationship and Ongoing Support

Financial planning is not a do-it-once thing. As your life evolves, so do your financial objectives. The benefit of working with an advisory firm is there is someone to make changes to your plan along the way.

Whatever it is a career change, a new family member in your home, investing in property or planning for retirement an advisor walks you through every step. Not only is their job to build your wealth, but also to maintain it and help you use it in the correct manner over a time period.

Final Thoughts

Dubai's financial advisory firms are not exclusive to the rich. It's a smart move for anyone who wants to get their money in order and make the right choices for a better future. From helping you choose the right life insurance policy UAE residents prefer, to building sound investment plans, financial planners bring sense and organization into what otherwise might feel overwhelming. We understand at Sijomathews that not all financial journeys are linear. That's why we listen, we evaluate, and create plans as unique as you are. When you're ready to move forward to financial security, our team is here to assist you to do so wisely and safely.