Financial Planning for Freelancers in 2025

A Real-World Guide from My Own Freelance Journey

The Freelance Challenge We Dont Talk About Enough

When I started freelancing, I didnt give much thought to financial planning. I just focused on getting clients and delivering work. But after a few months, I realized the income wasnt as steady as I hoped, and I didnt have a plan for slow periods or unexpected expenses. Thats when I started to take my finances seriouslynot just for survival, but for sustainability.

In 2025, freelancing continues to grow, and more people are entering the space. But with freedom comes responsibility. Unlike a salaried job, freelancing means no automatic paycheck, no employer-sponsored retirement plan, and no built-in benefits. Thats why financial planning isnt optionalits essential.

I didnt have it all figured out at first. But with a few key adjustments, I learned how to manage my income, save for taxes, and create a buffer that gave me peace of mind.

Step One: Tracking Every Source and Every Expense

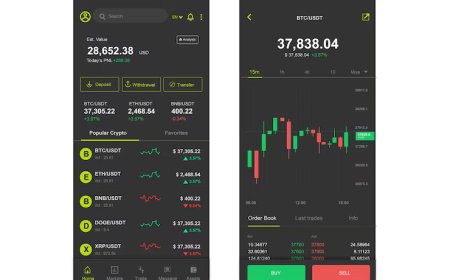

The first step for me was getting clear on what money was coming in and where it was going out. Freelancers often have income from multiple clients, sometimes in different currencies or payment platforms. Without a system, its easy to lose track.

Heres what worked for me:

-

I set up a separate business bank account. This helped me keep my personal and freelance expenses clearly divided.

-

I used a simple spreadsheet and tracking app. Every project payment, software subscription, or business lunch got logged.

-

I reviewed everything weekly. That 15-minute check-in helped me catch irregularities and stay in control.

The goal wasnt perfectionit was awareness. Once I had that, I could make better choices month to month. I remember a specific week when I wanted to try a new electronic cigarette, but I held off because I knew I had quarterly taxes due. That small moment of planning saved me stress later.

Step Two: Planning for Taxes Before They Surprise Me

One of the most important things Ive learned is to treat taxes as a monthly habitnot a once-a-year panic. In the early days, I didnt set aside enough. That changed quickly after my first tax season.

Now I do this:

-

Set aside 25%30% of every payment. That money goes into a separate high-yield savings account.

-

Use accounting software to estimate taxes. It gives me a running estimate, so Im not guessing.

-

Work with a tax professional once a year. Even though I track everything, I still need expert advice for deductions and local laws.

This system turned something stressful into a routine. Knowing my tax money is already set aside lets me focus on work instead of worrying about the future.

Step Three: Creating a Consistent Income Flow

Freelance income isnt always predictable, but that doesnt mean it cant be stable. What helped me was building a base of recurring clients and setting minimum income goals each month.

Heres how I approached it:

-

I offered monthly retainers to steady clients. This gave both of us predictability.

-

I diversified my services. When one type of work slowed down, I leaned into another.

-

I tracked my lowest income months from the past year. Then I saved enough to cover at least two of those months.

That way, if a client pauses or leaves, I have time to adjust without panic. One time, a project got delayed for weeks, but I was covered thanks to the emergency fund Id built up earlier.

Its not just about savingits about thinking ahead and being ready to bridge any income gap.

Step Four: Setting Personal and Business Goals Together

Freelancing can blur the lines between work and life. Thats why I set both personal and business financial goalsand review them together.

I ask myself questions like:

-

How much do I want to earn this year?

-

How much time off can I afford to take?

-

What tools or training should I invest in this quarter?

This helps me stay grounded. Im not just chasing projectsIm working toward a life I want. And that includes having space to enjoy small things.

Just last weekend, after hitting my monthly target, I relaxed with a new vape stick while catching up on a few podcasts. It wasnt a big splurge, but it was part of the balance Im trying to buildearning, planning, and enjoying in a sustainable way.

Final Thoughts: Freelancing With a Plan Is Powerful

Freelancing in 2025 is full of opportunity, but it also demands more from us financially. Theres no boss managing our budgets or setting up retirement plans. That job falls to us.

And the good news? Its absolutely doable.

Im not a financial expert, but by staying organized, planning ahead, and being realistic, Ive built a system that supports my work and my life. The freedom that drew me to freelancing is still thereits just backed by a structure that gives me peace of mind.

If youre freelancing or thinking about it, Id say start simple. Track your income, build your savings, and be intentional about how you grow. You dont need a perfect systemjust one that helps you stay consistent.

Over time, the habits you build now will give you more choices, more stability, and more confidence. Thats what financial planning is really abouthaving options and being ready for whatever comes next.