How Mutual Fund Investment Apps Make Investing Simple and Convenient?

These apps have helped people to invest, track and manage their investments with ease. This article provides you with a detailed understanding of how a mutual fund investment app simplifies investing with convenience.

In India, mutual funds have gradually emerged as the preferred investment option. They offer an easy way to participate in the financial markets. The investing approach in mutual funds has been enhanced with the introduction of the mutual funds app. These apps have helped people to invest, track and manage their investments with ease. This article provides you with a detailed understanding of how a mutual fund investment app simplifies investing with convenience.

Role of Mutual Fund Investment Apps in Simplifying Investments

The following is a breakdown of some reasons that make mutual fund apps a convenient option for investing:

Easy Account Opening Process

A major advantage of using amutual fundinvestment app is the smooth and quick account opening process. These apps provide a clean, user-friendly interface where all tools and information are easy to access. Users can complete their Know Your Customer (KYC) procedure digitally, removing the need for long forms or in-person verification.

The app helps the user through every step, from uploading identification documents to confirming personal details. The digital process is quick and follows Securities and Exchange Board of India (SEBI) guidelines, providing a legal and secure way of starting to invest.

Wide Range of Mutual Fund Choices

These apps offer access to a wide selection of mutual funds, such as equity, debt, and hybrid schemes. Using a reliable mutual fund app makes it easy to compare and select a mutual fund scheme that matches their investment goals and risk appetite.

Each fund comes with clear information on performance history, fund manager details, and risk classification. This helps the users get a clear understanding of their investment and allows them to choose an option that matches their long-term plans.

Convenience and Accessibility

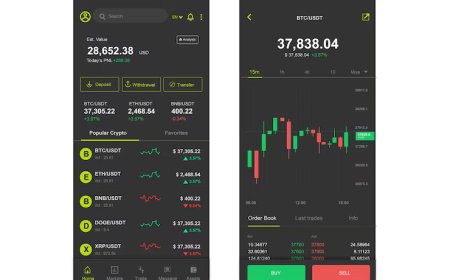

A key benefit of a mutual fund investment app is the convenience it gives to invest or manage your portfolio at any time. Users can log in via their phone or computer, without having to visit an office or contact an agent.

One can provide all the important documents that are needed for mutual fund investing, such as account statements, transaction history and fund reports. The app saves this data and made it available in real-time. This ease of access is particularly helpful for people who prefer to manage their investments on their own schedule.

Transparent and Secure Transactions

These apps are built with strong safety systems to protect users information and activities. From two-factor authentication to secure login methods, the entire process is designed to offer ease.

Every transaction is recorded clearly and can be viewed in detail. This allows users to track their steps and maintain full transparency in their investment journey. These features follow SEBI's investor protection rules, which make this app reliable for mutual fund investing.

Goal-Based Investing Tools

Several mutual fund investment apps offer features that allow users to set clear financial goals. Whether someone is saving for higher education, retirement, or a future event, the app helps them plan accordingly.

The app often suggests suitable mutual funds based on the goal of the user, time frame, and risk comfort. Some platforms also allow users to automate their investments through Systematic Investment Plans (SIPs), which makes the process disciplined.

Educational Resources and Support

A well-designedmutual fund investment appusually includes helpful learning material, such as short articles, videos, and answers to common questions. These resources help to understand the basics of investment concepts in a simple way, which makes this app useful for beginners.

Most platforms also offer quick support through live chat or call-back options. If users need help or dont understand something, assistance is just a tap away. This makes the whole experience more comfortable and informative.

Portfolio Tracking and Performance Monitoring

Keeping an eye on how investments are performing is important. With a mutual fund investment app, users can check real-time updates on their holdings, view returns, and monitor how their investments are divided across different types of funds.

Detailed reports and graphs help users make changes to their strategy if needed. This ongoing access allows people to stay in control of their investments and feel more confident in their decisions.

Regulatory Compliance and Investor Protection

All mutual fund investment apps in India must follow strict guidelines set by SEBI. These rules are meant to protect investors and ensure all processes are fair and clear.

Apps must show full details about each fund, including performance records, risk levels, and charges. This helps users make well-informed decisions and builds long-term trust in the platform.

Conclusion

Mutual fund investment apps have made it easier for Indian investors to start and manage their investments. These platforms simplify everything, from setting up your account to choosing the right fund. It further offers helpful tools to plan, track, and grow your investments. With digital safety, user-friendly features, and SEBI compliance, they give investors both confidence and control. This makes the mutual fund investment app a smart, flexible solution.