How to Install Paytm App

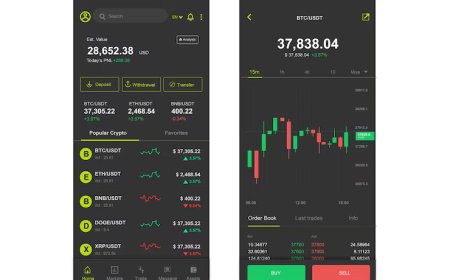

How to Install Paytm App The Paytm app has become one of the most essential digital tools for millions of Indians, transforming the way people manage payments, recharge, shop, invest, and even access financial services. Whether you're paying for groceries, booking a cab, splitting a bill with friends, or paying utility bills, Paytm offers a seamless, secure, and fast experience—all from your smart

How to Install Paytm App

The Paytm app has become one of the most essential digital tools for millions of Indians, transforming the way people manage payments, recharge, shop, invest, and even access financial services. Whether you're paying for groceries, booking a cab, splitting a bill with friends, or paying utility bills, Paytm offers a seamless, secure, and fast experienceall from your smartphone. Installing the Paytm app is the first step toward unlocking this comprehensive digital ecosystem. While the process seems straightforward, ensuring a secure, error-free installation with optimal settings can make a significant difference in your long-term experience. This guide walks you through every aspect of installing the Paytm app, from initial download to post-installation configuration, with best practices, real-world examples, and answers to common questions.

Step-by-Step Guide

Installing the Paytm app is designed to be user-friendly, regardless of your technical proficiency. However, following the correct steps ensures you avoid common pitfalls such as downloading from unofficial sources, missing critical permissions, or encountering installation failures. Below is a comprehensive, step-by-step breakdown tailored for both Android and iOS users.

For Android Users

Android devices offer multiple ways to install apps, but for security and reliability, we recommend using the official Google Play Store. Heres how to proceed:

- Unlock your Android device and ensure youre connected to a stable Wi-Fi or mobile data network. A strong connection prevents interrupted downloads.

- Open the Google Play Store app. If its not on your home screen, locate it in your app drawer. Look for the iconic white shopping bag with a colored play button.

- Tap the search bar at the top of the screen. Type Paytm using the on-screen keyboard. Avoid typing variations like Pay Tm or PayTM as these may lead to unrelated results.

- Select the official Paytm app from the search results. The developer should be listed as One97 Communications Ltd. and the app icon should display the distinctive orange and white logo with the P symbol. Verify the number of downloadsover 500 millionto confirm authenticity.

- Tap the Install button. You may be prompted to accept permissions such as access to SMS, camera, storage, and location. These are necessary for features like UPI payments, scanning QR codes, and OTP verification. Review them carefully and tap Accept if you agree.

- Wait for the download and installation to complete. The progress bar will appear beneath the app icon. This typically takes less than a minute on fast networks.

- Tap Open once installation finishes. Alternatively, you can find the Paytm icon on your home screen or app drawer and tap it manually.

If the Play Store is unavailable or restricted on your device, you can install Paytm via APK file. However, this method carries higher risks and should only be used if absolutely necessary.

Installing via APK (Advanced Users Only)

Before proceeding, understand that downloading APKs from third-party websites can expose your device to malware or spyware. Only use trusted sources like the official Paytm website (paytm.com).

- Enable installation from unknown sources. Go to Settings > Security (or Privacy) > Unknown Sources and toggle it on. On newer Android versions, this setting may appear under Settings > Apps > Special Access > Install Unknown Apps. Select your browser (e.g., Chrome) and allow installations.

- Open your browser and navigate to https://paytm.com/download.

- Download the latest APK file. Tap the Android download button. Wait for the file to save to your Downloads folder.

- Open your file manager and locate the downloaded Paytm.apk file.

- Tap the file to begin installation. Youll see a warning about installing from an unknown sourceconfirm by tapping Install.

- Wait for completion, then tap Open to launch the app.

- Disable unknown sources again for enhanced security after installation.

For iOS Users

iOS users benefit from Apples tightly controlled App Store ecosystem, which minimizes security risks. The installation process is even simpler than on Android.

- Unlock your iPhone or iPad and ensure youre connected to Wi-Fi or cellular data.

- Open the App Store. The icon is a blue background with a white A.

- Tap the search icon at the bottom right corner of the screen.

- Type Paytm into the search bar. As you type, suggestions will appear. Select the official Paytm app by One97 Communications Ltd.

- Verify the developer name and rating. The app should have a 4.5+ rating and over 10 million downloads. Avoid any apps with similar names or low ratings.

- Tap the Get button (or cloud icon if previously downloaded). You may be prompted to authenticate with Face ID, Touch ID, or your Apple ID password.

- Wait for installation to complete. The icon will appear on your home screen with a progress circle.

- Tap Open once installed, or locate the Paytm icon manually.

Post-Installation Setup

After launching the Paytm app for the first time, youll be guided through an onboarding process. Follow these steps to complete setup:

- Enter your mobile number. This must be a number registered in your name and capable of receiving SMS. Tap Continue.

- Verify your number. An OTP (One-Time Password) will be sent via SMS. Enter it in the app. If you dont receive it within 30 seconds, tap Resend OTP.

- Create a 6-digit Paytm PIN. This is your transaction password. Choose a unique combinationavoid birthdays or sequential numbers like 123456.

- Set up biometric authentication (optional but recommended). Enable fingerprint or face recognition for faster logins and payments.

- Link your bank account or add a payment method. You can link your UPI ID, debit/credit card, or add money to your Paytm Wallet. This step is essential for making payments.

- Complete KYC (Know Your Customer). For full access to features like wallet balance, fund transfers, and bill payments, complete your KYC using Aadhaar or PAN. This is a one-time requirement and takes less than 5 minutes.

Once completed, youre ready to use Paytm for all your digital transactions. Explore the dashboard to find features like Recharge & Bill Payments, Paytm Mall, Paytm Postpaid, Paytm Money, and Paytm Payments Bank.

Best Practices

Installing the Paytm app is just the beginning. To ensure long-term security, performance, and usability, follow these industry-tested best practices.

1. Always Download from Official Sources

Never install Paytm from third-party app stores, Telegram bots, or random websites. These may contain modified versions with hidden malware designed to steal your login credentials or banking details. Only use the Google Play Store or Apple App Store. If downloading via APK, use paytm.com exclusively.

2. Keep the App Updated

Paytm releases regular updates that include security patches, bug fixes, and new features. Enable auto-updates in your app store settings. On Android, go to Play Store > Profile > Settings > Network Preferences > Auto-update apps. On iOS, go to Settings > App Store > toggle on App Updates.

3. Use Strong, Unique Passwords and PINs

Your Paytm PIN and login credentials should never be reused across other platforms. Avoid easily guessable combinations like 000000, 111111, or your birth year. Use a mix of numbers and consider enabling two-factor authentication (2FA) if available.

4. Enable Biometric Authentication

Biometric login (fingerprint or face recognition) adds a critical layer of security. Even if someone gains access to your phone, they cannot initiate payments without your biometric verification. This feature is available on most modern devices and should be activated immediately after installation.

5. Monitor App Permissions

Paytm requires access to SMS (for OTPs), camera (for QR scanning), and storage (for receipts). However, it does not need access to your contacts, microphone, or location for core functions. Periodically review permissions: On Android, go to Settings > Apps > Paytm > Permissions. On iOS, go to Settings > Paytm > Permissions. Disable any non-essential access.

6. Avoid Public Wi-Fi for Transactions

While you can browse Paytm on public networks, never conduct financial transactions over unsecured Wi-Fi. Use your mobile data or a trusted home network. If you must use public Wi-Fi, enable a reputable VPN service.

7. Regularly Review Transaction History

Check your Paytm transaction history weekly. Look for unfamiliar payments or unauthorized deductions. If you spot anything suspicious, immediately report it through the in-app support feature and change your PIN.

8. Secure Your Phone

A locked phone is the first line of defense. Use a strong screen lockPIN, pattern, or biometrics. Enable remote wipe features like Find My Device (Android) or Find My iPhone (iOS). If your phone is lost or stolen, you can remotely erase your Paytm data.

9. Beware of Phishing Attempts

Paytm will never ask for your PIN, UPI ID, or OTP via call, SMS, or email. If you receive such a message, delete it immediately. Do not click on links in unsolicited messageseven if they appear to come from Paytm Support. Always open the app directly from your home screen.

10. Backup Your Data

While Paytm stores your account data on its servers, its wise to keep a record of your registered mobile number, KYC details, and linked bank accounts in a secure, offline location. This helps during account recovery or if you switch devices.

Tools and Resources

Several tools and official resources can enhance your Paytm experience and simplify the installation and usage process. Below is a curated list of trusted tools, links, and utilities recommended by digital security experts.

Official Paytm Website

https://paytm.com is your primary source for downloading the app, checking service status, reading terms and conditions, and accessing help articles. Always verify URLs before entering any personal information.

Paytm Help Center

The Paytm Help Center (https://help.paytm.com) provides detailed guides on installation, troubleshooting, KYC, and feature usage. It includes video tutorials and step-by-step articles in multiple Indian languages.

Google Play Store & Apple App Store

These are the only recommended platforms for downloading Paytm. Both platforms scan apps for malware and enforce strict developer policies. Avoid sideloading unless absolutely necessary.

Antivirus Software (Android)

For added security on Android, consider installing a reputable antivirus app like Bitdefender, Kaspersky, or Norton. These tools can scan downloaded APK files and alert you to potential threats before installation.

VPN Services (Optional)

If you frequently use public networks, a trusted VPN like ExpressVPN, NordVPN, or ProtonVPN can encrypt your traffic and protect your financial data. Ensure the VPN has a no-logs policy and supports strong encryption protocols.

Device Security Tools

Enable built-in security features:

- Android: Google Play Protect, Find My Device

- iOS: Find My iPhone, Screen Time, App Privacy Report

QR Code Scanner (Built-in)

Modern smartphones have built-in QR scanners in the camera app. You dont need a separate app to scan Paytm QR codes. Simply open your camera, point it at the code, and tap the notification that appears.

Uptime Monitoring Tools

If you suspect Paytm is down, check real-time service status using tools like downforeveryoneorjustme.com or isitdownrightnow.com. This helps distinguish between local device issues and platform-wide outages.

Official Social Media Channels

Follow Paytms verified social media accounts on Twitter (@Paytm) and Facebook for announcements about app updates, maintenance schedules, and security alerts. These channels are more reliable than third-party blogs or forums.

Real Examples

Real-world scenarios illustrate how proper installation and usage of the Paytm app can make daily life easierand how mistakes can lead to complications.

Example 1: Student in Delhi Uses Paytm for Daily Expenses

Riya, a 20-year-old student in Delhi, installed Paytm after her college introduced digital payments for cafeteria and library fees. She downloaded the app from the Play Store, verified her number, and linked her student bank account. She enabled fingerprint login and turned off unnecessary permissions like contacts and location. Within a week, she used Paytm to pay for bus rides, recharge her phone, order food via Swiggy, and split rent with her roommate. She never experienced a failed transaction and felt secure knowing her PIN was never shared.

Example 2: Shopkeeper in Jaipur Avoids Fraud

Mr. Sharma, a small shop owner in Jaipur, received a call from someone claiming to be from Paytm Support, asking for his OTP to activate a new feature. He ignored the call and instead opened the Paytm app to check his balance. He noticed a failed transaction attempt from an unknown number. He immediately changed his PIN and reported the incident through the in-app Report Fraud option. He later learned that Paytm had flagged the attempt as suspicious and blocked it automatically. His quick action prevented financial loss.

Example 3: Tourist in Mumbai Fails to Install via Third-Party Site

A tourist from the UK tried to install Paytm on his Android phone using a link found on a travel blog. The APK he downloaded appeared legitimate but contained a keylogger. Within two days, his bank account was drained. He had to contact his bank, freeze his cards, and file a report with local authorities. He later learned that Paytm never distributes APKs through third-party blogs. He reinstalled the app from the Play Store and enabled 2FA before using it again.

Example 4: Senior Citizen in Bengaluru Completes KYC Successfully

Ms. Patel, 68, was hesitant to use digital payments. Her grandson helped her install Paytm from the App Store. He walked her through the OTP verification and guided her to complete KYC using her Aadhaar card via the apps video verification feature. She now uses Paytm to pay her electricity bill, send money to her grandchildren, and even buy groceries online. She says the apps simple interface and voice-assisted navigation made it easy to learn.

Example 5: Business Owner Integrates Paytm for Payments

A small caf in Pune installed a Paytm QR code sticker at the counter. The owner downloaded the Paytm Business app from the Play Store, verified his shop details, and linked his savings account. He now receives payments instantly, generates digital receipts, and tracks daily sales through the dashboard. He no longer handles cash, reducing the risk of theft and making accounting easier.

FAQs

Can I install Paytm on two phones at the same time?

Yes, you can install the Paytm app on multiple devices. However, you can only be logged in on one device at a time. Logging in on a new device will automatically log you out of the previous one. For security, always log out from old devices before switching.

Do I need a bank account to use Paytm?

No, you can use Paytm without a bank account by adding money to your Paytm Wallet using a debit/credit card or UPI. However, to transfer money to others or withdraw cash, you must link a bank account and complete KYC.

Why does Paytm need access to my SMS?

Paytm requires SMS access to automatically read OTPs sent during login and transaction verification. This eliminates the need to manually copy and paste codes, making the process faster and more secure. You can disable this permission after setup, but youll need to enter OTPs manually each time.

Is Paytm safe to use after recent data breaches?

Paytm has never experienced a confirmed data breach affecting user financial data. In 2021, a third-party vendor experienced a minor exposure, but Paytm confirmed no customer data was compromised. The app uses end-to-end encryption, tokenization for card details, and RBI-compliant security protocols. Always use official channels and avoid phishing attempts.

What if I forget my Paytm PIN?

If you forget your PIN, tap Forgot PIN? on the login screen. Youll be prompted to verify your identity via OTP or biometrics. Once verified, you can reset your PIN. If you cant access your registered number, contact Paytm support through the in-app chat for account recovery.

Can I use Paytm without an internet connection?

No, Paytm requires an active internet connection to authenticate transactions, send OTPs, and update balances. However, you can generate a QR code offline and scan it later when online. Some features like viewing past transactions may work in offline mode, but payments require connectivity.

How do I know if the Paytm app is genuine?

Look for the following indicators: Developer name One97 Communications Ltd., over 500 million downloads on Android, 4.5+ rating, official logo (orange P on white), and the app being available only on Google Play Store or Apple App Store. Avoid apps with misspelled names like PayTm, PayTM, or PaytM.

Can I install Paytm on a tablet?

Yes, Paytm is fully compatible with Android tablets and iPads. The interface automatically adjusts for larger screens. You can use it for bill payments, shopping, and even video KYC on a tablet.

Does Paytm work on older Android or iOS versions?

Paytm supports Android 7.0 and above, and iOS 12.0 and above. If youre using an older device, the app may not install or may crash frequently. Consider upgrading your device or using Paytm via mobile web at https://m.paytm.com.

How long does KYC take to complete?

KYC via Aadhaar or PAN typically takes less than 5 minutes. Video KYC may take up to 15 minutes depending on network speed and document clarity. Once submitted, verification is usually completed within 2448 hours.

Conclusion

Installing the Paytm app is more than a simple downloadits the gateway to a secure, efficient, and future-ready digital life. Whether youre a student, professional, small business owner, or senior citizen, Paytm empowers you to manage finances with confidence. By following the step-by-step guide, adhering to best practices, and leveraging trusted tools, you ensure that your installation is not only successful but also secure. Real-world examples show how proper usage prevents fraud, saves time, and enhances convenience. Always prioritize official sources, keep your app updated, and remain vigilant against phishing attempts. With Paytm, youre not just installing an appyoure adopting a smarter, cashless lifestyle. Take the first step today, and experience the ease of digital payments at your fingertips.