Rising Credit Card Rates Worry Indian Consumers in 2025

India sees a surge in credit card interest rates in 2025. Learn how this finance trend is affecting spending habits, debt management, and financial planning.

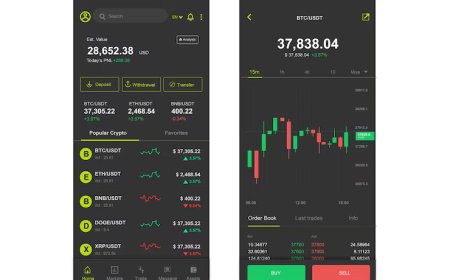

In 2025, many Indian consumers are taking a closer look at their credit card usage. Interest rates on credit cards have been climbing steadily over the past few months, creating concern among those who rely on them for daily expenses and emergencies. While the increase is driven by policy decisions and inflationary pressures, it has prompted many to reconsider their spending habits. The change is especially noticeable in urban areas where access to financial services is widespread, and people often make cashless transactions even for items like groceries or essentials from nearby cigarette shops.

Whats Driving the Rise in Credit Card Rates

Several key factors are contributing to the upward trend in credit card interest rates across India:

-

Repo Rate Hikes: The Reserve Bank of India (RBI) has increased the repo rate multiple times since late 2024 to manage inflation, prompting banks to pass on the cost to consumers.

-

Higher Inflation: General inflation in sectors like transportation, fuel, and essentials is affecting the overall economy, prompting card issuers to reassess lending risk.

-

Shift in Spending Behavior: The digital boom post-2020 has led to an increase in card-based purchases, encouraging banks to adjust rates based on usage trends.

-

Increase in Credit Risk: Some banks have seen a slight increase in delayed payments, leading to tighter lending conditions and revised APRs.

Despite these changes, financial institutions continue to offer rewards and cashback programs to encourage responsible card use, helping consumers manage rising costs.

How Consumers Are Responding to the Change

Rather than stepping away from credit cards entirely, many Indians are adjusting their approach to using them. Here's how consumers are adapting:

-

More Budgeting Apps: A growing number of users are relying on mobile apps to track spending and manage bill due dates effectively.

-

Shift to EMI Options: To avoid high interest rates on large purchases, consumers are opting for EMI-based payment plans with lower processing charges.

-

Preference for Co-Branded Cards: People are choosing cards with benefits like flight discounts, retail rewards, or grocery cashback to maximize every rupee spent.

-

Increased Awareness: There's a noticeable trend of people becoming more financially literate, paying attention to terms like APR, due date grace periods, and credit utilization.

Banks and fintech companies are also educating customers through webinars and SMS alerts to help them manage payments and avoid penalties.

Why Credit Cards Still Make Sense for Indian Shoppers

Even with rising rates, credit cards remain a practical financial tool for many Indians. Used wisely, they offer benefits that other payment methods do not:

-

Short-Term Credit: For salaried individuals, a credit card provides 3050 days of interest-free credit, helpful during the second half of the month.

-

Emergency Funds: Unplanned medical or home repair expenses can be managed easily with a credit limit available instantly.

-

Reward Points & Cashback: Spending on groceries, online shopping, and fuel can accumulate points that translate to real savings.

-

Building a Credit Score: Timely repayment helps improve creditworthiness, leading to better loan offers and approvals.

As more people shift to digital payments, credit cards are seen as a secure and trackable option compared to cash transactions.

What to Expect for the Rest of 2025

While it's hard to predict exact figures, financial analysts believe that rates might stay steady or rise slightly through the remainder of 2025. However, there are positive signs too:

-

Fintech Growth: Several startups are offering innovative credit solutions with transparent interest policies and easy repayment tools.

-

Increased Competition: With more banks entering the credit card market, customers could benefit from better terms and promotional rates.

-

Policy Adaptations: The RBI may introduce measures to make personal credit more accessible and responsible, which could stabilize rates over time.

For now, staying informed and using credit strategically can help users avoid financial stress and continue benefiting from digital payments. As card usage increases, so does access to services like loyalty programs, fuel station partnerships, and even discounts at restaurants or retail chains. Consumers are taking advantage of these benefits while managing their repayments more carefully.

While discussing digital purchasing habits, it's also worth noting how consumers are combining their lifestyle and convenience needs. Many now search online for personal preferences such as vape juice near me, making the most of cashless payments and on-the-go ordering options. This trend reflects a shift toward smarter financial habits, supported by evolving payment tools and informed spending.